- Can you catergorize personal expenses in quickbooks how to#

- Can you catergorize personal expenses in quickbooks software#

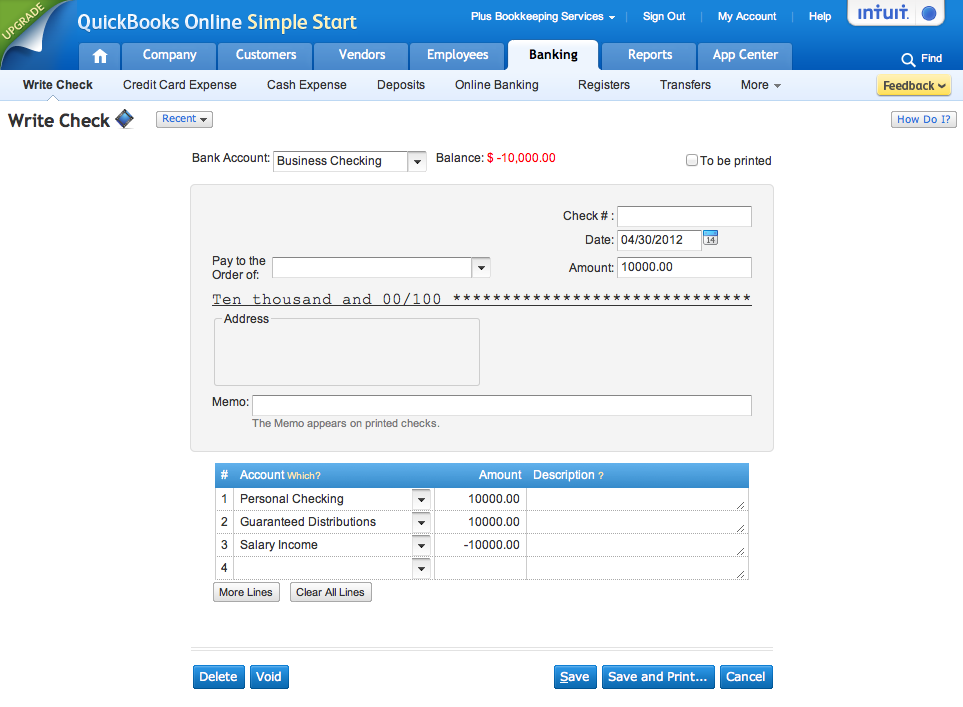

Sole proprietorships and partnerships do not pay taxes on their profits any profit earned by the business is reported as income on the owners’ personal tax returns. Click the Expenses tab, and then select the account category that best fits your needs.īecause an owner’s drawing is not a business expense, it does not appear on the income statement and thus has no bearing on the company’s net income.From the PAY TO THE ORDER OF field, select the vendor’s name.Select the Bank Account, Cash Account, or Credit Card you used to make the purchase.How do you categorize owner expenses in QuickBooks? When you put money into the business, you use an equity account as well. What is owner’s draw vs owner’s equity in QuickBooks?Ĭan someone please explain the difference between Owner Draw and Owner Equity? When you take money out of the business, you use an equity account.

Recording owner’s draws To record owner’s draws, go to your balance sheet’s Owner’s Equity Account and debit your Owner’s Draw Account while crediting your Cash Account.

Can you catergorize personal expenses in quickbooks how to#

How to record business account withdrawals We recommend reading: Readers ask: How To Draw A Star Without Lines? How do I categorize a drawing in QuickBooks?

Can you catergorize personal expenses in quickbooks software#

Looking to streamline your accounting process? Patriot’s accounting software allows you to quickly and easily record your business transactions so you can get back to running your business. Recording owner’s drawsĪny money an owner draws during the year must be recorded in an Owner’s Draw Account. Taking larger draws can be risky because if the owner’s draw is too large, the business may not have enough funds to move forward. Taking large drawsĭetermine the maximum amount you can take in owner’s draws and stick to it. Business owners who take draws must typically pay estimated taxes and self-employment taxes, and some may choose to pay themselves a salary instead.Īn owner’s draw determines how much you pay yourself the amount may fluctuate depending on your business you should also consider operating costs and other expenses before deciding how much to pay yourself with an owner’s draw. Are owner’s draws taxable?Ī business owner’s draw is not taxable on the company’s income, but it is taxable as income on the owner’s personal tax return. Corporations, such as an S Corp, typically cannot take owner’s withdrawals. In most cases, you must be a sole proprietor, an LLC member, or a partner in a partnership to take owner’s withdrawals. Owner’s equity is made up of a variety of funds, including money you’ve invested in your company. What is an owner’s draw?Īn owner’s draw occurs when a business owner withdraws funds from their company for personal use rather than paying themselves a salary. You probably pay wages to your employees as a business owner, but how do you pay yourself? Depending on your business structure, you may be able to pay yourself an owner’s draw.

0 kommentar(er)

0 kommentar(er)